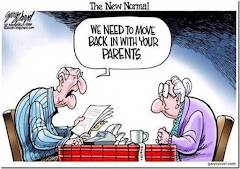

Everybody looks forward to retirement. I recently heard that 70% of today's employees are unhappy with their present jobs. Many are hoping that soon they can quit and enjoy the "leisurely days" of retirement. But will they really ever be able to do so? That is an interesting question. Few companies are now offering defined pension plans. The futures of social security and medicare are very uncertain. Most folks have not saved nearly enough to retire. And the growing question is how can a retiree handle exploding medical costs? Whenever I hear of somebody planning to retire I would like to ask them how they will handle their medical bills. Fidelity Investments recently conducted some polls and they found that over half of those considering retirement felt that $50,000 would be enough to cover their medical needs. Fidelity estimates that a couple of 65 year olds retiring in 2013 will need at least $220,000 to cover their medical insurances and bills. The good news is that this is an 8% drop in the previous year's estimate of $240,000. Now if medicare survives, it does provide some relief for those who purchase A and B and a D plan. But that will only cover about 66% of one's costs and does not include over the counter purchases, dental, hearing and vision costs. Nor does it cover long-term care needs which could wipe out one's savings. And medical bills are rapidly increasing and will continue to do so. Dianne recently had her annual colonoscopy and her bill was $3,294. I had a biopsy and my bill was $6,613. I had two cataract surgeries and my total bills for those were $18,153. Now medicare wrote off about half of these costs. But that means that a non-medicare patient probably will be billed more for the doctors to regain these medicare write offs. Medicare took care of 80% of the remainder of these charges and our gap policy and personal savings took care of the rest. In addition, because of special physical needs that we have, for the first five months of this year are medicines have cost us $5,460. And to help with those costs our insurances for the first six months of this year have cost us $4,176. With those costs and other bills we have shelled out $8,332 in medical bills for the first six months of this year. That is a chunk of money for anyone, retired or not. Now I am not sharing this to gain any pity. Far from it. I am just sharing the facts. I thank the Lord for relatively good health and for the resources to pay the bills. If we would have had problems with hospitalizations and major surgeries and maybe even nursing home care, it would be much worse. And those things do become more common the older you become. So I think Fidelity's estimate of $220,000 is not too high. And I warn any of you who are nearing retirement to make sure that you have counted the costs. Retirement is great when you are healthy and can pay the bills. But it is a real challenge when the cost of everything continue to rise and your income doesn't. Of course Obama care will take care of all of these medical concerns. It will probably do that by eliminating surgeries and refusing adequate care for those who are over 70. So more seniors will just pass on more quickly with less care and less expense. And, of course, euthanasia will most likely be the next step. But then we seniors should probably better be able to more fully agree with Paul's comments, "For to me to live is Christ, but to die is gain".

Sunday, June 30, 2013

Tuesday, June 25, 2013

Liberty Or Not

For about 50 years I have had my auto insurance with Liberty Mutual and I have never had any problems at all. Now I've not had any traffic tickets and very few claims during that time, so other than paying my bill, I've not had to deal with them very much. Now as many of you may know, last January a lady went through a red light and hit us. She admitted it was her fault but unfortunately I didn't have any witnesses or a police report. And then she decided to lie to her insurance company and claim that I went through the light. So for months our companies each claimed the other was guilty. Finally it went to binding arbitration and the arbitrator couldn't assign guilt - so I guess we are both guilty. So we are out $500. My main gripe, other than that I don't think they really represented me in the early negotiations, is that I had to make all the contacts with them to find out what was happening. Then a few months ago we had a seat belt accident with Dianne being injured. No auto claims were involved but I was forced to go through Liberty Mutual because it happened in the car. Her claims were paid and their customer service was very helpful. But they are still showing both cases as being open and that is causing me problems. That leads to the main problem. When I received my bill for the coming year I was disappointed that it again went up 12%, even though I was not charged with the accidents. I talked to AAA and they quoted the very same insurance for about $700 less, but they couldn't write a policy because my two claims were still shown as open. I then contacted the company that has my homeowners policy and they couldn't give me a quote since the claims were still open. So I called Liberty Mutual and told them that I was thinking about leaving them. I sent them an email asking several questions but I never got a response. So I finally called the office and found that suddenly they were able to give me the very same policy for $500 less. The agent told me that she had met with her manager and since I was a long time customer they would give me this break. Amazing! Why couldn't they have offered that to me originally instead of bilking me out of another $500 if I had just renewed without any questions. So I thanked them and told them that I would stay with them given the new quote. Actually I have no choice until they decide to close the two claims. Since I had only 17 days until my policy would lapse, they said they would immediately put the papers in the mail for me to sign. Twelve days later they still hadn't shown up. So when we got home from vacation I called them. My agent was on vacation but another one said she would take care of it. She also offered me a new way to pay for it monthly without additional cost. I hadn't been made aware of that option. Four days later I received the application to sign. But as I was reviewing it, I realized that it was not the same as my previous policy. There were two differences, the major of which was that they had dropped the collision on my 2009 Toyota completely. I would have had no coverage at all had I caused an accident or had a repeat of the January situation. That was a major change. I called the agent and she said that they had made a mistake and it would now cost me $98 more to get the same coverage I have had. Now I am only saving $400 which is $300 more than AAA's quote. How could the agent and her manager have made that mistake? Was it really a mistake or a way to bring the price down so I would stay with them? What if I wouldn't have caught it? Why must I pay for their mistake? I have asked those questions in letters which I have sent to their regional and national offices. But I really don't expect any answers or changes. It will be interesting to see if they do respond or stand behind their original quote. Stay tuned. But buyer beware. Never sign without reading the details. Can you trust any business today? I guess for the time being I have no choice but to stay with them since nobody else will deal with me until they close my two claims and that should have been done a month ago. And since my old policy ended on June 23, I need coverage now. So by their delays and possible deception I have had no choice but to renew. But as I mentioned I did learn that when you have your charge deducted automatically each month from your checking account, there is no additional fee. So I will do that and that will give me the chance to cancel their coverage whenever I want to and not lose any money waiting for a refund. And that is a plan! If you have an agent or a company that you trust and can recommend, please let me know. I haven't shopped for auto insurance for about 50 years so it may be a new but necessary adventure.

Thursday, June 20, 2013

Birthday Cards

Many old traditions are becoming a thing of the past. One of those is the giving of birthday cards. There are probably several reasons for this decline. First is the cost of buying and sending cards. A nice card can now cost nearly $5 plus postage. The second is because folks just don't care about others like they used to or they are just too busy to remember. This year on my birthday I received three cards from relatives and six from others. They were really appreciated, especially since a couple came from folks who surprised me. This year I did miss receiving a humorous card from my best friend, Jim, who passed away over a year ago. Last year I did receive one, two months after his death. He had picked it out for me months before that. Now some folks have gone to sending electronic cards. I admit that we often use these to congratulate folks on their anniversary. They usually are free, cost nothing to send, and can be very attractive. And while they are better than receiving nothing at all, they just aren't quite the same as receiving one in the "snail" mail, especially if it includes a personal comment But they at least show some kindness from the one who took time to e-mail it. For many years we - or I should say my wife - have made it a point to send birthday cards not only to our relatives but also to most of our friends, especially those from church. It takes much time and it does cost us some money to do this, but we send out several dozen each month. We really do it as a ministry of encouragement and friendship. And quite often we receive very positive feedback of sincere appreciation for the cards, even from teens who often don't express appreciation. And many look forward to this card since they receive so few, especially from non family members. Recently a mother and father in our church came to thank us not only for their cards, but especially for those sent to their children. Now my conclusion is that in the rush of this technological world people need friends who really care and take time to show it. And they sincerely appreciate those who do care and demonstrate it, even if it is with something small like the giving of a birthday card That can be money very well spent.

Saturday, June 15, 2013

Integrity

Somebody recently sent me a story about integrity, something which seems to be missing in today's society. I pass it on to you for your review. A successful businessman knew it was time to choose a successor to lead his business. Instead of appointing one of his directors, or one of his children, he decided to call the company's young executives together. He said, "It is time for me to choose the next CEO. I have decided to select one of you." The young executives were shocked, but the CEO continued. "I am going to give each of you a SEED today - a very special SEED. Plant the seed, water it, and one year from today bring what you have grown from the seed I have given you. I will judge the plants you bring, and choose our next CEO." One of the leaders, Jim, excitedly told his wife about the plan. She helped him get a pot, soil and compost, and he planted his seed. Every day, he watered it and watched to see if it had grown. Soon some of the other executives began talking about their seeds and the plants beginning to grow. Jim kept checking his seed, but nothing ever grew. Weeks went by, but still nothing. Everyone else was talking about their plants, but Jim had no growth and felt like a failure. Six months passed, but still nothing in Jim's pot. He concluded he had killed his seed, but said nothing to his colleagues. He continued watering and fertilizing the soil - he desperately wanted his seed to grow. When the year ended, the young executives were instructed to bring their plants to the CEO for inspection. Jim told his wife he refused to take an empty pot to his workplace, but she urged him to be honest about what had happened. It was going to be Jim's most embarrassing moment, but he knew his wife was right. Jim took his empty pot to the boardroom. When he arrived, the variety of plants the other executives had grown amazed him. They were beautiful - in many shapes and sizes. When Jim put his empty pot on the floor, many of his colleagues laughed. When the CEO arrived, Jim attempted to conceal himself in back. "My, what wonderful plants, trees and flowers you have grown," said the CEO. "Today one of you will be appointed the next CEO!" Then the CEO noticed Jim. He invited Jim to the front - with his empty pot. Jim was terrified. "The CEO knows I'm a failure! Maybe he will have me fired!" When Jim got to the front, the CEO asked what had happened to his seed. Jim explained despite his best efforts, nothing had grown. The CEO turned to the group and asked everyone to sit down, except Jim. He then looked at Jim and announced, "Behold your next Chief Executive Officer! His name is Jim!" Then the CEO explained: "One year ago today, I gave everyone in this room a seed. I told you to take the seed, plant it, water it, and bring it back in a year. But I gave you all boiled seeds; it was not possible for them to grow. All of you, except Jim, have brought healthy plants and flowers. When you found the seed would not grow, you substituted a different one. Jim was the only one with the courage and honesty to bring me a pot with my seed in it. Therefore, he is the one who will be the new Chief Executive Officer!" It is said: If you plant honesty, you will reap trust. If you plant goodness, you will reap friends. If you plant humility, you will reap greatness. If you plant perseverance, you will reap contentment. If you plant hard work, you will reap success. If you plant forgiveness, you will reap reconciliation. If you plant faith, you will reap a harvest. So be careful what you plant now: it will determine what you will reap later. "The man of integrity walks securely, but he who takes crooked paths will be found out" (Proverbs 10:9). "The integrity of the upright guides them, but the unfaithful are destroyed by their duplicity" (Proverbs 11:3)

Monday, June 10, 2013

Through The Clouds

Recently we took a trip by air and the experience served as an interesting object lesson to me. On previous trips I've experienced all sorts of weather. Sometimes it was beautiful and clear and you could clearly see the ground. Sometimes we've flown above the clouds where the sun shines brightly. Sometimes we've briefly flown through clouds and storms. But on this last trip it seemed like we flew through clouds almost the entire trip. Sometimes it was a little bumpy, but really not that bad. But as I sat looking out of my window I was amazed again at how the plane could be flown without the pilot being able to see where we were going. How did he know what direction to fly? How did he know another plane wasn't headed in our path? The answer is simple - radar. Radar is an amazing invention. Among many other applications, pilots can place their faith in radar and guide us through the clouds, darkness, and storms to a safe destination. And as I thought about that I realized that this is a good example of the life of a Christian. Daily we travel through unknown circumstances and clouds. Sometimes the sailing is calm, other times life can be quite bumpy. We can't always see what is ahead or what tomorrow may hold. But we put our faith in One who is more powerful, reliable and faithful than even the best radar device that man has. We know He knows not only our today's but also our tomorrow's. And our need is to trust Him to guide us through whatever is ahead. When I was growing up there was a chorus which we sang quite often, especially in prayer meetings. "My Lord knows the way through the wilderness, all I have to do is follow. My Lord knows the way through the wilderness, all I have to do is follow. Strength for today is mine always, and all that I need for tomorrow. My Lord knows the way through the wilderness, all I have to do is follow." And whether it be the wilderness or the hidden tomorrow, He does know the way. And He does provide the strength and all that we need for tomorrow. Maybe at times we just need to be reminded of this truth. And as the radar led our plane safely to our destination, so the Lord will lead us to the destination He has promised us.

Wednesday, June 5, 2013

View From The Mirror

Do you enjoy watching people? I think it is interesting to sit in a shopping mall or another similar area and just watch the people pass by. You see some interesting sights when you take the time to watch. Recently I have been watching people in another situation - using the rear view mirror in my car. Now I don't do that when I am driving, only when I am stopped at a traffic light. And I have seen some interesting things. The most common sight is watching folks talk on their cell phones. What in the world did people do before cell phones? And why must they use them when driving? And even though it is illegal, I often see folks - especially young drivers - tenting. Accidents waiting to happen. Then there are those who are using their mirrors to fix their hair or their make-up - generally women. However, I once even saw a man shaving. I guess some drivers just don't get up early enough to get ready before they leave home. And of course there are the musicians, bouncing and swaying along to their music. Sometimes you even see their hands clapping and swaying. And, of course, there are those who are enjoying some food - sometimes drinking (I hope not alcohol) and sometimes chewing on a sandwich or a snack. And then there are those who are in the midst of a conversation with another rider or correcting their children. It is interesting what you can see through your rear view mirror. But often there are those who are just sitting there calmly or maybe even impatiently, waiting for the light to turn. Sometimes their faces are blank or maybe have a smile or maybe they look grumpy. I thought about this recently when a car was following me from Millersville towards Park City. Every time we stopped the driver behind me looked so grumpy and sad. I couldn't help but wonder if that was her normal expression, if she was just tired, or if she had a real problem. Then she pulled into the LGH Health Campus and it went through my mind that maybe she was late for work or maybe she was going there for some serious tests. Maybe her face was really reflecting her fears or worries. I will never know. But then the thought came to my mind that maybe a good simple ministry would be to pray for her as well as for other folks who I view in the rear view mirror. Then the words of Steve Green's famous song came to my mind. "Everyday they pass me by, I can see it in their eyes. Empty people filled with care, Headed who knows where? On they go through private pain, Living fear to fear. Laughter hides their silent cries, Only Jesus hears. People need the Lord, people need the Lord. At the end of broken dreams, He's the open door. People need the Lord, people need the Lord. When will we realize, people need the Lord?" What a profound truth which has given me a new motivation for using my rear view mirror while I am waiting for the traffic light to change. Maybe you want to join me in this new rear view mirror ministry.

Subscribe to:

Comments (Atom)