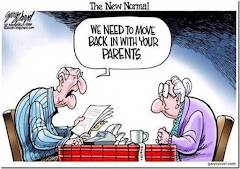

I continue to be utterly amazed at the amount of debt that folks have today. The desire to have the best of everything, immediately, just drives so many people into debt that they will probably never pay off. Those desires, coupled with the lack of financial sense, cripples folks and our nation as well. Here are some alarming facts from the Employees Benefit Research Institute which illustrate the problem. (1) 28 percent of Americans - the most since the annual survey began 23 years ago - say they have no confidence in their ability to afford a comfortable retirement. (2) The survey showed that an alarming number of Americans expect to have to work well past retirement age. (3) 59% of credit card holders carry a balance from month to month. (4) 68% of American households live paycheck to paycheck. (5) The median household net worth of Americans is $57,000. (6) One third of retirees live on Social Security alone (average monthly social security $1,230). If that isn't alarming enough, the National Association of Personal Financial Advisors (NAPFA) published the results of a survey about the importance of financial planning that add more light to the problem. (1) 56% of U.S. adults lack a budget (68% live paycheck to paycheck). (2) 40% of U.S. adults were saving less in 2012 than in 2011 (they use their credit cards for emergencies). (3) 39% of U.S. adults have no non-retirement savings. (4) In 1991 only 11% of American workers expected to retire after age 65. In 2012 that percentage had risen to 37%. Today folks are living with foreclosures, bankruptcy, huge credit card debt on several different cards, and loans which they may never be able to pay off. For some this debt driven life begins with huge college debt in earn a degree. Many will never even find a job in their field. Then they'll spend most of their life just paying off this bill. Often this problem explodes when couples get married. Today they need a huge wedding ceremony with loads of flowers, expensive gowns, fancy locations, elaborate receptions, and loads of pictures. Then they need an expensive honeymoon to some exotic location. And suddenly they are already thousands in debt ... or maybe their parents are now deep in debt. We were married using a borrowed gown and a regular suit in a church ceremony with flowers just for the wedding party. All who wanted to attend the wedding were welcome. A friend took our wedding pictures as his wedding gift. We had a reception in the YMCA serving sandwiches made by the ladies from the church. We left for our honeymoon at Watkins Glen on Saturday night and returned Monday. And we still have wonderful memories, without any debt, and in June our marriage will have lasted 51 years. That is a sharp contrast to what often happens today with weddings and marriages. And if that isn't enough, today newly married couples need to immediately buy their own house and fill it with expensive furniture and, of course, purchase new cars as well. Their parents and grandparents probably went decades until they had what many newly married couples get immediately today. Unfortunately, today we live in a society where our "wanters" are far bigger than what most can really afford ... but there are always the credit cards and loans. And our federal government leads and models the way to debt. There is so much more that I would like to get off my chest on this subject - maybe I'll devote another blog or two to this topic. In the meantime - pay off those credit cards now and evaluate and control your "wanter"!

Saturday, May 11, 2013

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment